Freya, a 24-year-old, is among many young people struggling to step onto the property ladder with no clear solution in sight. With mortgage rates at their highest since the financial crash and soaring rent costs, her worries about the future are shared by many others. Renters, too, express their frustration, feeling like they have little hope of saving enough money to gather a deposit for a house.

Despite some support from her family to gather a deposit, Freya finds herself facing challenges due to high interest rates and a lack of affordable properties that meet her living standards. Currently, she spends nearly half of her salary on renting. As a scientific content creator for an educational games company, Freya holds a well-paid job, but she questions how single young professionals like her can afford to buy a property without further assistance. Her salary falls short of the threshold required to secure a £200,000 mortgage.

Freya expresses her frustration, recalling the advice from previous generations that a good degree would pave the way for success, which hasn’t materialized for her. Despite working full-time, she struggles to earn enough to make property ownership a reality. Freya leads a frugal lifestyle, rarely going out or indulging in non-essential expenses like dining out, yet the financial barrier remains.

Freya currently pays £775 in monthly rent, not including bills, for her one-bedroom flat in Cardiff. However, she finds the high cost of renting frustrating, especially when the properties often come with significant issues. She has encountered low-quality properties in the Welsh capital, and in a previous place, she faced a collapsed ceiling that left her unable to sleep due to the cold.

Freya reflects on the challenges faced by young people in saving for their future, as the high cost of renting makes it difficult to accumulate enough savings to transition from renting to owning a property. This financial hurdle can be disheartening for many young individuals who aspire to own their own homes.

Mortgage rates have surged to their highest level in 15 years, with a typical five-year fixed mortgage deal now carrying an interest rate of over 6%, a level not witnessed since the financial crisis. The Bank of England’s prediction of rising mortgage payments, expected to increase by at least £500 per month for nearly one million households by the end of 2026, is adding significant financial pressure on homeowners.

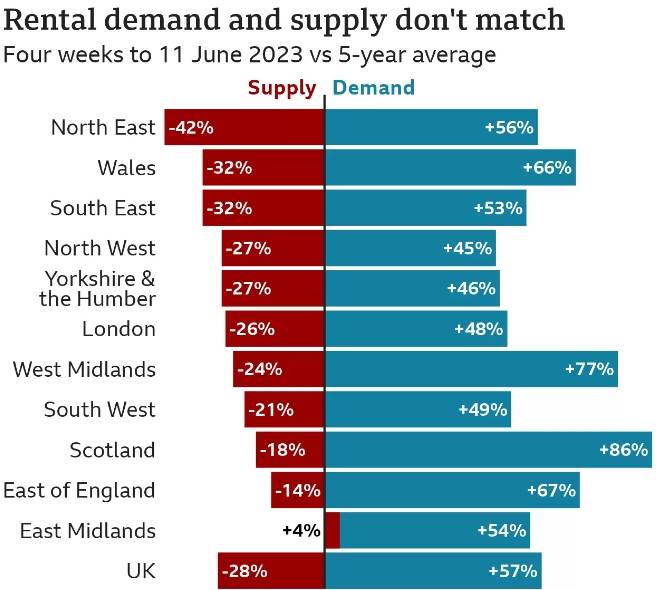

The situation is compounded by a significant decrease in available homes, down by a third, further intensifying the challenges for potential buyers. Wales’ First Minister, Mark Drakeford, has expressed criticism towards the Bank of England’s actions, arguing that the bank’s decision to raise interest rates in an attempt to control inflation may result in “avoidable” hardship for thousands and put the economy at risk of a recession. He accused the central bank of being overly aggressive in its approach.

“It is evident from their statements that they intend to increase interest rates to a level that will lead to rising unemployment across the entire United Kingdom, and this includes Wales,” remarked Wales’ First Minister, Mark Drakeford.

He emphasized that the impact of the interest rate increases implemented so far by the Bank of England has not yet been fully felt.

Referring to the views of Andy Haldane, the former chief economist of the Bank of England, Mr. Drakeford expressed concerns that the bank’s approach might prioritize squeezing out the last remnants of inflation at the cost of inflicting avoidable misery upon countless lives.

The Bank of England has been approached for a comment regarding the current situation. However, the surging housing costs are not limited to mortgages. According to data from Zoopla, the average rent in the UK increased by 11.1% in the year leading up to January 2023, with Cardiff experiencing a 10.8% rise. Notably, Neath Port Talbot in Wales saw the highest increase in rent levels at 16%.

Andrew Noel, aged 29, expressed concern that renting is discouraging people like him from saving, especially when they are unable to afford a mortgage. Currently living in Cardiff with a housemate, Andrew is facing the challenge of finding a new property as he must leave his current one in February. He shared his struggles in searching for a place that won’t exhaust their monthly wages, as they also need to cover energy bills. Andrew emphasized that spending £900 each on rent is a substantial amount of money, and it shouldn’t be such a financial burden.

Andrew pointed out that the only viable option for average earners in his age group to buy a property is either to live with their parents for an extended period to save for high interest rates or to purchase a home as a couple. He expressed his current view that buying a property is not feasible unless some unforeseen and favorable circumstances occur. Andrew suggested that implementing rent controls might be the only effective way to address the problem.

It’s important to note that interest rates are determined by the Bank of England for the entire UK, while housing policies and regulations are handled separately in Wales, being a devolved matter.

The Welsh government stated that they firmly believe in providing every individual with access to affordable and suitable housing. They have pledged to release a White Paper that explores the possibility of implementing fair rent systems and introducing innovative approaches to make housing more affordable for local residents.

Mr. Drakeford, speaking on BBC Radio Wales Breakfast, also declared the Welsh government’s commitment to constructing “20,000 affordable homes for social rent” within this Senedd term. However, Housing Minister Julie James expressed concerns last year that achieving this target was uncertain due to the challenges posed by the state of the economy.